!

Anti-Money Laundering and

Counter-Terrorism Financing Program

“AML/CTF Program”

!

ANTI-MONEY LAUNDERING AND COUNTER-TERRORISM FINANCING PROGRAM

“AML/CTF PROGRAM”

INTRODUCTION

prepared to deal.

The Anti-Money Laundering and Counter-

Terrorism Financing Act 2006 (the “AML/CTF Act”)

THE PURPOSE OF AML/CTF RISK

became effective on 12 December 2006. However,

ASSESSMENT

some parts of the AML/CTF Act commenced in a

phased approach up to December 2008.

The purpose of our AML Risk Assessment is to

identify, mitigate and manage our potential ML/TF

1TradeMarket Limited trading as 1TradeMarket

risk. This Part A of the AML/CTF Program formally

(“1TradeMarket”) is a Reporting Entity on the basis

documents that in identifying our ML/TF risks, 1TradeMarket

that it provides a Designated Service (as defined in

has considered the risk posed by the following

section 6 of the AML/CTF Act).

factors:

Pursuant to the AML/CTF Act a Reporting Entity

(a)! our customer types, including beneficial owners

must have and comply with an AML/CTF Program.

of customers and any Politically Exposed

The AML/CTF Program is divided into Part A

Persons

(PEPs)

(domestic, international

(general) and Part B (customer identification).

organisation and foreign);

This AML/CTF Program has been prepared so that

(b)! the source of funds and wealth of our

1TradeMarket can assess the potential money laundering

customers;

and terrorist financing (“ML/TF”) risks to which it

may be exposed and to manage those risks within

(c)! the nature and purpose of the business

the legislative framework.

relationship with our customers;

This AML/CTF Program was adopted by 1TradeMarket on

(d)! control structures of non-individual customers,

July 25th 2013. The AML/CTF program was last

and the beneficial owners of our customers;

updated on September 11th 2018.

(e)! the types of designated services we provide;

PART A

(f)! the methods by which we deliver our

The primary purpose of Part A of this AML/CTF

designated services;

Program is to identify, mitigate and manage the

risk that 1TradeMarket may reasonably face (inadvertently or

(g)! the foreign jurisdictions with which we deal.

otherwise) by facilitating money laundering or

terrorism financing through the provision of its

The identification of the ML/TF risks potentially

designated services.

faced by 1TradeMarket enables us to design and implement

the controls and measures required to mitigate

In this AML/CTF Program, “we”, “us” or “our” means

and manage these risks.

1TradeMarket.

1TradeMarket has conducted a full risk assessment of the

BUSINESS OVERVIEW

business which has formed the basis of this

1TradeMarket is a company structured primarily to provide

program. The purpose of this risk assessment is to

general advice, dealing and market making

identify what ML/TF risks exist for 1TradeMarket when

services in derivatives and foreign exchange

providing designated services. The two risk types:

contracts to both retail and wholesale clients.

business risks and regulatory risks have both been

considered.

1TradeMarket’ primary mode of operandi is by way of an

electronic trading platform which operates over

The risks identified have then been

the Internet i.e. 1TradeMarket gives clients direct online

assessed/measured in terms of a combination of:

access to the rates/prices in the derivatives and

foreign exchange markets at which 1TradeMarket is

•!Likelihood that these will occur

2 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

foreign);

•!Impact of the consequence of loss or severity

of damage that may result if these do occur

•!

Customers who are identified as being persons

or entities which support terrorist activity or are

Scales of likelihood and impact within a risk matrix

named in government lists or with credible

have been combined to generate a matrix of risk

scores. Risk appetite, tolerance and treatment has

sources in respect of corruption and/or criminal

also been defined.

activity;

1TradeMarket is committed to ensuring that its procedures

•!

Nature, volume and frequency of trading

and policies prevent its services (and products)

having regard to the financial standing of the

customer;

from being used to facilitate money laundering or

terrorist financing.

•!

Customers (not necessarily PEPs) based in, or

WHY IS 1TradeMarket AT RISK?

conducting business in or through, a high risk

geographic location, or a geographic location

Some of the risk themes currently faced by 1TradeMarket

with known higher levels of corruption or

have been set out below (this list is not

organized

crime,

or

drug

production/distribution;

exhaustive).

•! Live chat facility;

•!

Opportunities are presented for criminals to

engage in transnational activities have

•! 1TradeMarket’s customer base is growing and from all

expanded

with

globalisation

and

over the globe;

•! Interactions are non-face to face; preferred by

advancements

in

information

and

criminals;

communications technologies. Cyber-criminal

activities increasingly affect the financial

•! Various electronic forms of payment credit

cards used to trade

security of online business. It is widely accepted

•! E-payments is a known method to dispose of

that the financial and insurance industry is the

‘target of choice’ for financially motivated cyber

illegally obtained funds,

criminals;

i.e. spending or receiving illegitimate money via

trading accounts.

•!

Professional service providers such as lawyers,

accountants, investment brokers or other

HOW WE IDENTIFY, MITIGATE AND

professionals holding accounts for their

MANAGE ML/TF RISK

customers or acting on behalf of their customer

and where we would be required to place an

•! Risk Factors

unreasonable reliance on the professional

service provider;

For the purposes of the AML/CTF Act and Rules, in

identifying its ML/TF risks, 1TradeMarket has considered the

•!

Requests for undue levels of secrecy with a

risks posed by the seven factors listed in paragraph

transaction;

2 above and set out in detail below. Thus, certain

customer types, source of funds and wealth,

•!

Whether the customer is a long-standing

business relationships and control structures,

customer

or

undertakes

occasional

designated services, delivery methods, foreign

transactions; and

jurisdiction considerations are all factors that can

result in a higher ML/TF risk.

•!

the customer’s business activities place the

At a high-level, risk factors that we may reasonably

customer in a high-risk category;

face are identified as follows:

•!

Customers who wish to use pre-paid credit

(i)! Customer Types, (including beneficial owners of

cards and the associated risks with the digital

customers);

payments arena.

•! Any politically exposed persons PEP’s

CUSTOMERS’ SOURCE OF FUNDS AND

(domestic, international organisation and

3 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

WEALTH

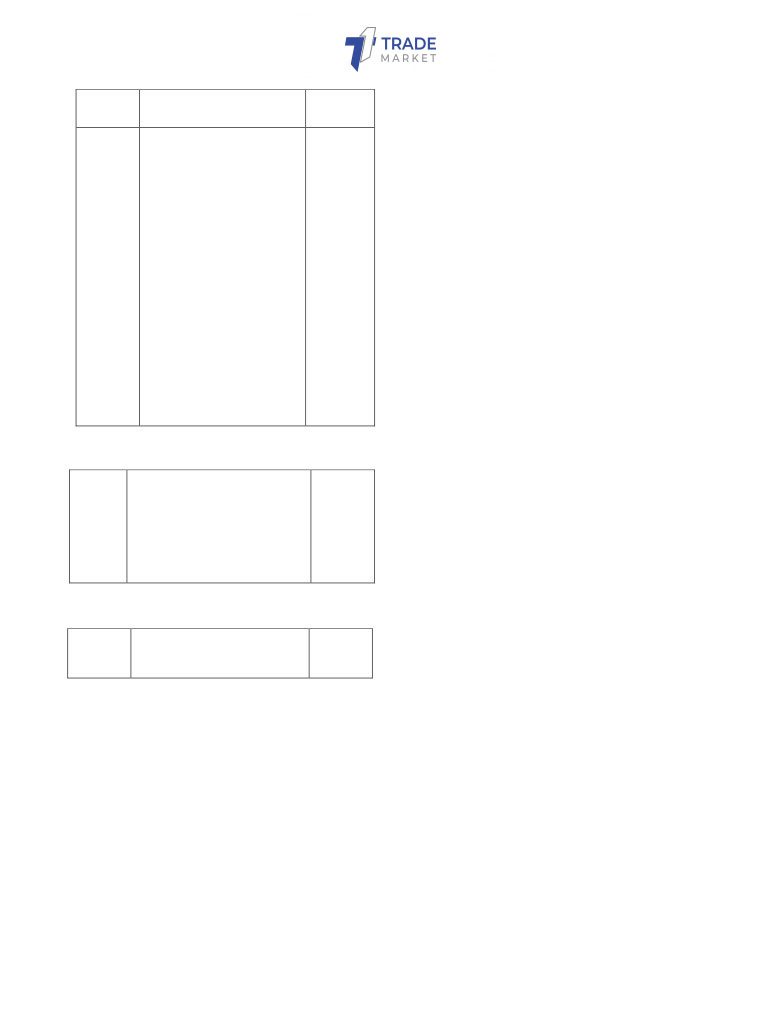

The list of Designated Services (located in Section 6

•! Sources of wealth - the origin of the entire

of the AML/CTF Act) has been reviewed and the

body of wealth gives an indication of the

ones that 1TradeMarket provide have been identified and

volume of wealth of the customer. Whether it

ranked as low.

is at the expected level;

Forex

•! Source of funds - the origin of funds or assets

which are the subject matter of the business

relationship between the customer and 1TradeMarket.

Designat

Risk

ed

Description

Ranking

•! Where the origin of wealth or source of funds

Service

cannot be easily verified.

Item 33

Provision of a designated service in

Low

the capacity of agent of a person,

acquiring or disposing of:

(ii)! The nature and purpose of the business

(a)! a security; or

relationship with its customers,

(b)! a derivative; or

(c)! a foreign exchange

•! Risks arising from changes in the nature of the

contract; on behalf

business relationship, control structure or

of the person,

beneficial owner of 1TradeMarket’s customers;

where:

(d)! the acquisition or disposal is in

•! Intended type and level of transactions to be

the course of carrying on a

carried out and risks associated with those

business of acquiring or

transactions. Larger transactions present

disposing

of

securities,

derivatives or foreign exchange

higher AML/TF risk.

contracts in the capacity of

agent; and

(iii)! The control structure of non-individual

(e)! the service is not specified in the

customers

AML/CTF Rules

Item 35

Provision of a designated service

Low

•! 1TradeMarket can only be satisfied that it knows who the

in issuing or selling a security or

beneficial owner is if they know who ultimately

derivative to a person, where:

owns or controls the customer - either directly,

or indirectly through interests in the

(a)! the issue or sale is in the course

of carrying on a business of

customer’s beneficial owner(s);

issuing or selling securities or

derivatives; and

•! Where there is a failure to identify who

(b)! in the case of an issue of a

ultimately controls the business relationship

security or derivative—the issue

preventing developing a clear understanding of

does not consist of the issue by

the AML/TF risk associated with the business

a company of a security of the

relationship;

company or of an option to

acquire a

•! Where the structure of the customer/entity

renders it difficult to identify the true controlling

owner, or where there is no legitimate

commercial rationale for the structure.

(i)! The Types of Designated Services We Provide

4 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

Designate

Risk

Description

(i)! Methods by which we Deliver

d Service

Ranking

Designated Services

security of the company; and

(c)! in the case of an issue of a

•! Online

security or derivative—the

issue does not consist of the

•! Telephone

issue by a government body

•! Live chat facility

of a security of the

similar measures;

government body or of an

option to acquire a security

•!

Countries identified by credible sources as

of the government body;

having significant levels of corruption and/or

and

criminal activity;

(d)! in the case of an issue of a

•!

Countries identified by credible sources as

security or derivative—the

issue is not an exempt

lacking appropriate AML/CTF legislation/

financial market operator

systems/ measures or controls;

issue; and

•!

Countries identified by the FATF as non-co-

(e)! such other conditions (if

operative countries and territories;

any) as are set out in the

AML/CTF Rules are satisfied

•!

Countries identified by credible sources as

being tax havens;

Forex/ Bullion

•!

Countries that are materially associated with

production and/or transnational-shipment of

Item 54

Provision of a designated service

Low

illicit drugs.

in the capacity of holder financial

services

license,

making

By way of an example a Risk Matrix which was

arrangements for a person to

formulated from the Financial Action Task Force on

receive a designated service

Money Laundering

(“FATF”) Guidance Note,

(other than a service covered by

entitled “Guidance on the risk based approach to

this item).

combating money laundering and terrorist

financing,” sets out general risk assessment criteria.

Bullion

A RISK BASED AML/CTF PROGRAM

Item 1

Selling bullion, where the

Low

selling is in the due course of

This AML/CTF Program is risk based.

carrying on a business*

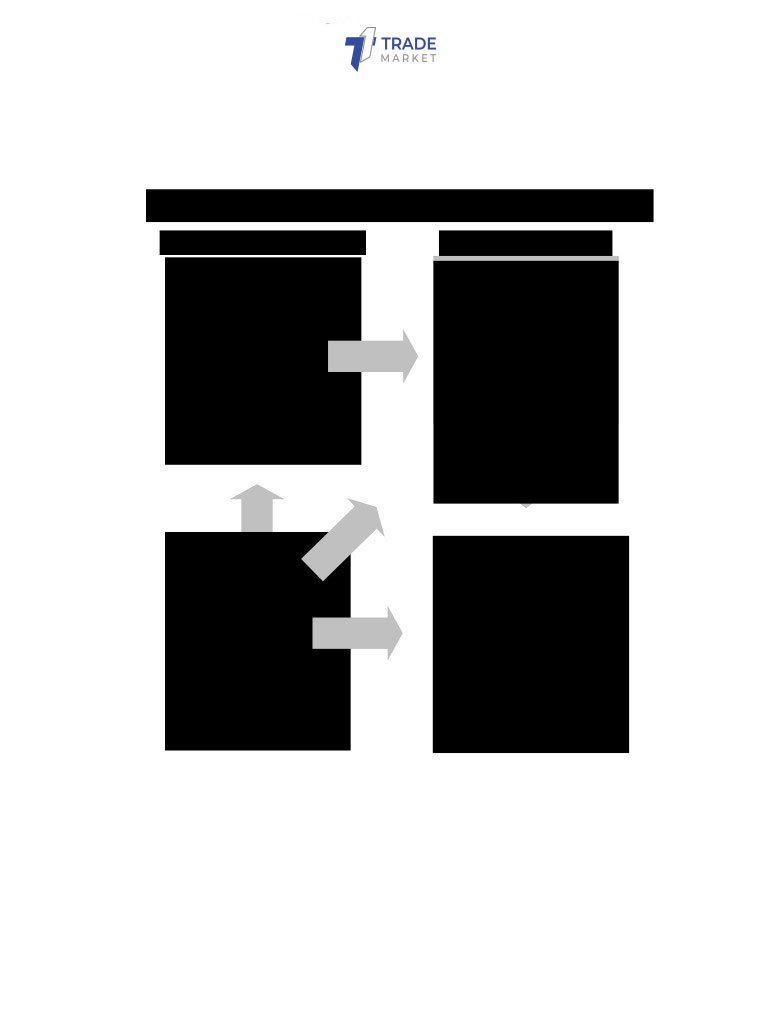

The following diagram, formulated from the FATF

(i)! Foreign Jurisdictions

“Guidance on the risk based approach to combating

•! Countries identified by credible sources as

money laundering and terrorist financing”, sets out

providing funding or support for terrorist

the suggested risk assessment and management

activities or who have terrorist groups

controls process that should be implemented.

working within the country;

•! Countries subject to sanctions, embargoes or

5 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

!

Risk!Assessment!Link!to!the!AML/CTF!Risk!Management!

Risk!Assessment!

Internal!Controls!

Identify!&!Measure!Risk:!

!

Develop!Applicable:!

Customers(

Policies(

Services(

Procedures(

Delivery(Methods(

Systems(

Foreign(Jurisdictions(

●Source(of(funds(

Controls(

●Nature(and(purpose(of(

!

!

business(relationship(

Results!

●Control(

structures(

(

(

Audit!

Risk4Based!Compliance!

Review(of(the(risk(

Program!

assessment(and(

adequacy(of(internal(

Internal(controls(

controls.(Also(reviews(

Audit(program(

the(controls’(

Compliance(

effectiveness(through(

a(risk>based(audit(

Training(

program(

6 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

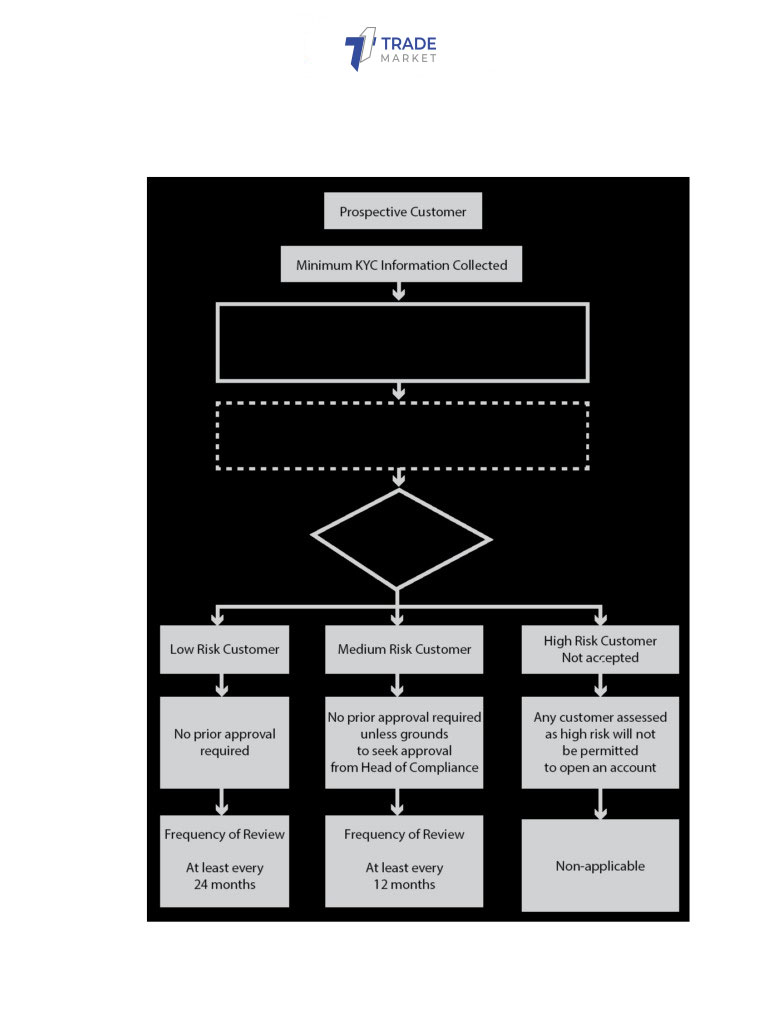

Identify, verify and then assess the customer

establishing or continuing the business

relationship with them.

The following steps are performed in identifying,

verifying and performing a risk assessment of the

customer:

STEP

3. Additional KYC information is

obtained to identify and verify the customer

STEP 1. Initial (or minimum) KYC information is

where the identity is unclear or non-verifiable

obtained to identify and verify the customer as

required by the AML/CTF Rules

If the minimum KYC information is considered

insufficient and 1TradeMarket is unable to identify and

1TradeMarket will initially seek to identify and then verify

verify the customer, then further

(additional)

the customer is who they claim to be. As a result,

questions must be asked of the customer so that

initial questions / information must be obtained to

the identity of the customer can be verified with

identify (and verify) the person. This is referred to

confidence.

as

“Know Your Client information” or

“KYC

information”.

STEP 4. A risk assessment is performed with

respect to that customer

Beneficial owners and control structures are

determined and KYC information is collected and

1TradeMarket is then required to carry out a risk

verified. 1TradeMarket review the parties to the trust deed;

assessment as to its exposure to facilitating money

identify major shareholders; understand the

laundering and/or terrorism financing by its

customer’s

management structure; and

customer in order to identify, mitigate and

understand the rights and responsibilities of

manage the risk identified. To mitigate risk, 1TradeMarket

senior managers to determine control structures.

has taken the decision that Customers deemed to

be high risk at the outset are not offered an

1TradeMarket has strict KYC procedures to verify the

account.

applicant’s identity. Manual verification is under

taken when a customer does not pass electronic

The assessment of ML/TF exposure must be risk

verification (EV). World Check (for international

based. The Act requires an assessment based

clients)

upon the following risk factors:

STEP 2. Identify whether a customer is a PEP

(1)! the types of customers we have (including

beneficial owners and PEPs);

1TradeMarket determines whether any customer or

(2)! the types of designated services we provide;

beneficial owner is a PEP (domestic, international

(3)! the methods by which we deliver our

organisation or foreign). Where a customer is

designated services; and

determined to be a PEP, 1TradeMarket collect and verify

(4)! the foreign jurisdictions with which we deal;

KYC information. 1TradeMarket then determine whether

(5)! Source of funds and wealth of customers

the PEP poses a high ML/TF risk. Additional due

(6)! The nature and purpose of the business

diligence measures and risk management

relationships with its customers

systems are implemented where the PEP is high

(7)! Control structures of non-individual customers

ML/TF risk or a foreign PEP. Foreign PEP’s are

and the beneficial owners of customers.

always classified as high risk.

Following this assessment, ML/TF risk of that

If a customer is a foreign PEP or a domestic or

customer is then measured or classified as low,

international organisation PEP who is assessed as

medium or high.

being a high ML/TF risk, 1TradeMarket take additional

measures such as taking reasonable measures to

establish the source of wealth and funds; and

require senior management approval before

providing the PEP with designated services or

7 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

The process by which 1TradeMarket will assess risk and formulate and implement

management control processes is set out diagrammatically below:

8 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

This Part A of the AML/CTF Program is designed

of Compliance must be notified prior to 1TradeMarket:

to identify, mitigate and manage the possible

ML/TF risks posed to 1TradeMarket and to document the

(i)! introducing a new designated service to the

controls and systems to address those risks. Any

market;

weakness in this Part A of the AML/CTF Program

(ii)! introducing new methods of delivery of a

may impact adversely on the management of the

designated service; and/or

ML/TF risks.

(iii)!introducing

any new or developing

technology used for the provision of

BOARD AND SENIOR MANAGEMENT

designated services.

OVERSIGHT

This will enable the AML/CTF Compliance Officer/

Head of Compliance to identify any significant

1TradeMarket’s Part A program must be approved by its

governing board and senior management. Part A

changes in ML/TF risks and to formulate controls to

mitigate and manage those risks.

must also be subject to the ongoing oversight of

the reporting entity’s board and senior

management. 1TradeMarket’s board and senior

Where procedures are updated, staff are formally

trained to ensure they are aware of the

management are dedicated to overseeing the

procedures relevant to their specialized role at

AML/CTF program to ensure compliance with the

Act.

1TradeMarket.

This AML/CTF Program has been adopted by the

TO ESTABLISH CUSTOMER

Board. Any amendment to this AML/CTF Program

IDENTIFICATION PROCEDURES

is subject to Board oversight and approval i.e. the

(COMMONLY KNOWN AS “KNOW YOUR

Board must formally adopt any amendment to the

CUSTOMER” OR “KYC” PROCEDURES)

AML/CTF Program.

The KYC procedures must be risk based having

The AML/CTF Compliance Officer/ Head of

regard to the ML/TF risks relevant to the provision

Compliance will provide a quarterly report to the

of the service/s offered. The procedures are

Compliance Committee and the Board, which will

designed to mitigate and manage the potential

include AML/CTF Program status reports and

ML/TF risks and ensure that 1TradeMarket is reasonably

incident reports. Quarterly compliance meetings

satisfied as to the true identity of its customers

have AML as an agenda item.

(clients).

This AML/CTF Program has been designed to

The customer identification and verification

ensure and demonstrate compliance with the

procedures are detailed in Part B of this AML/CTF

AML/CTF obligations as follows:

Program.

TO FORMALLY DOCUMENT POLICIES

TO IMPLEMENT EMPLOYEE DUE

AND PROCEDURES

DILIGENCE PROCEDURES / CHECKS

Money laundering and terrorist financing

There is a requirement within the AML/CTF Act to

schemes can be difficult to identify and criminals

perform due diligence on certain representatives

can be ingenious in formulating different schemes

of 1TradeMarket i.e. staff, employees, contractors, those

to facilitate their money laundering or terrorist

seconded to the company for an interim period etc.

financing agendas.

The level of due diligence required depends upon

the function performed and level of seniority / work

Accordingly, for this AML/CTF Program to be

performed.

effective, it requires regular review, and if

necessary amendment, in order that it

The employee due diligence program includes

accomplishes its purpose of identifying,

appropriate risk-based systems and controls for

mitigating and managing ML/TF risk.

1TradeMarket to determine whether to, and in what manner

to, screen any prospective employee and also re-

Further, the AML/CTF Compliance Officer/ Head

screen an employee (where that employee is

9 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

transferred or promoted) that may be in a position

procedures has been completed.

to facilitate the commission of a money laundering

or financing of terrorism offence in connection with

Examples of representatives to be considered as

the provision of a designated service by 1TradeMarket.

“high risk” include the following:

The employee due diligence program also

(i)! Representatives who are in a position of

establishes and maintains a system for 1TradeMarket to

dealing with customers or circumstances which

manage any employee who fails, without

are identified as high risk.

reasonable excuse, to comply with any system,

(ii)! Representatives in “key” positions.

control or procedure established in accordance

(iii)!Representatives that provide unusual or

with Part A or Part B of this AML/CTF Program

extraordinary activities.

(refer policy document entitled,

“Disciplinary

(iv)!Representatives who fail to conform to the

Action Procedures”).

company’s or Group’s compliance systems

and/or controls.

1TradeMarket has prepared a Recruitment Policy which

(v)! Staff promoted to more senior levels with

covers the vetting of candidates for employment,

greater AML/CTF responsibilities that are yet to

taking and checking of references and the

complete further AML/CTF training in policies

procedures to be followed in the recruitment

and procedures.

process.

(vi)!Representatives with lavish lifestyles, which

cannot be supported by the representative’s

The Recruitment Policy requires senior

salary or other practical reason.

management to conduct a formal interview of the

candidate. 1TradeMarket may also perform skills

The level of staff turnover will also be considered

assessment, reference checks or any combination

and monitored on a regular basis.

of these prior to offering a candidate a position.

Representatives will be selected on the basis of

Employees are not allowed to open a trading

their experience, skills, qualifications and industry

account with 1TradeMarket. This is to minimize the risks

knowledge.

associated with ML/TF. Customer accounts are

subjected to the AML/CTF procedures under the

The status of all new members of staff must be

supervision of the AML/CTF Compliance Officer/

identified

on their commencement of

Head of Compliance.

employment (authority to represent the company

and provide a designated service) and the

The performance of supervisors with respect to

identification must be verified and recorded i.e.

compliance with the AML/CTF obligations will be

1TradeMarket will ensure that the identity and past history

monitored as part of their annual performance

of a prospective employee (representative) has

review. Should any customer account be managed

been verified prior to employment or authority

by the AML/CTF Compliance Officer/ Head of

granted to represent the company.

Compliance then these will be reviewed by senior

management.

THE EMPLOYEE DUE DILIGENCE

Representatives who fail to comply with the

PROCEDURES

compliance systems and/or controls will be subject

to disciplinary procedures, which may include

Once employed (or appointed to represent the

termination of employment

(cancellation to

company), employees (representatives) that are

represent the company). Representatives that are

identified as “high risk” will be subject to closer and

suspected of facilitating money laundering or

more frequent monitoring. This includes

terrorism financing will be reported to the

monitoring of the representative’s customer

appropriate authorities.

accounts and relationships (i.e. monitoring will be

undertaken more frequently than that prescribed

by the regular intervals pursuant to internal audit

AML/CTF RISK AWARENESS TRAINING

procedures). In addition, these representatives

PROGRAM

may be subject to transactional limits until such

time that comprehensive training in policies and

Appropriate training with regard to money

10 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

laundering and terrorist financing is vital in

pamphlets, videos, intranet systems, in-person

managing the ML/TF risk. Accordingly, all

lectures, and explanatory memos.

representatives are required to undergo training in

AML/CTF laws and internal policies. In order that

Records of training are maintained to demonstrate

our ML/TF controls are successful, training

that the person/s attended the training session/s,

programs are formulated having regard to the

the dates of training, a brief description of the

representative’s level of responsibility and

subject matter of the training provided and the

position.

number of hours (or level of accreditation) for

Updated or refresher training will depend upon

attending the course/session/seminar.

staff promotions and/or depending upon the level

of assessed ML/TF risk of the designated service.

Certain key employees exposed to a greater ML/TF

Training will be carried out under the supervision

risk or those identified as “high risk” will undergo

of the AML/CTF Compliance Officer/ Head of

specialized additional training.

Compliance and senior management. Ongoing

general refresher training for all staff will occur on

AML/CTF COMPLIANCE OFFICER/ HEAD

a periodic basis (at least annually) and monthly

OF COMPLIANCE DUTIES

AML updates will be provided to all staff.

The AML/CTF Compliance Officer/ Head of

At a minimum the AML/CTF training program will

Compliance reports to the compliance committee

be designed to enable representatives to

and the Board.

understand the following:

The AML/CTF Compliance Officer’s/ Head of

Compliance duties specifically in relation to

(i)! the company (or Group’s) AML/CTF Policy;

ensuring compliance with the AML/CTF Act and

(ii)! the company (or Group’s) AML/CTF Program;

Rules include the following:

(iii)!the obligations of 1TradeMarket under the AML/CTF Act

and Rules;

(i)! monitoring compliance and adherence to the

(iv)!the types of ML/TF risk 1TradeMarket might face and the

obligations of the AML/CTF Act and Rules;

potential consequences of such risks;

(ii)! receiving

an investigating reports of

(v)! how to identify signs of ML/TF that arise during

suspicious matters activities;

the course of carrying out their duties;

(iii)! adopting a risk based approach to monitor

(vi)!escalation procedures i.e. what to do once a

customer activity to identify suspicious activity;

ML/TF risk is identified;

(iv)! overseeing communication and training for

(vii)what employees' roles are in the firm's

employees;

compliance efforts and how to perform them

(v)! ensuring that proper AML/CTF records are

i.e. the processes and procedures relevant to

maintained;

each person’s role;

(vi)! reporting suspicious activity to senior

(viii)! the company’s (or Group’s) record keeping

management, the Compliance Committee and

and record retention policy; and

the Board;

(ix)!the consequences (including civil and criminal

(vii)! submitting regular reports to the Compliance

penalties) for non- compliance with the

Committee (at least quarterly);

AML/CTF Act and supporting Rules

(Civil

(viii)! submitting regular reports to the Board (at

penalties of a maximum of $3.4 million for an

least annually);

individual and $17 million for a company apply

(ix)! providing advice to senior management, the

for non-compliance under the Act);

Compliance Committee and the Board;

(x)! Monthly closed jurisdiction updates;

(x)! lodging annual compliance report;

(xi)!AML Regulatory updates to update and inform

(xi)! receiving and carrying out directions or orders

staff, to ensure ongoing understanding of

issued by authorities; and

obligations.

(xii)! Liaison with regulatory bodies and law

enforcement in respect of suspicious activity

Training may be developed and provided either in

reporting.

house or by contracted training organizations,

external AML Consultants. Delivery of the training

The AML/CTF Compliance Officer/ Head of

may include written updates, educational

Compliance is authorized to act independently in

11 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

order to fulfil the commitments of his role.

smoothly and that they are happy with the

platform performance. Ongoing monitoring is

The AML/CTF Compliance Officer/ Head of

undertaken during this process and KYC

Compliance, under the direction of the Board, will

information verified to ensure it is up to date.

ensure that any government or FATF findings

Further, if any suspicion is aroused, further KYC

concerning the approach to money laundering

is collected and the SMR procedure is followed;

and/or terrorism financing prevention, in particular

countries or jurisdictions, is assessed and

(d)!

Initial courtesy calls are made to clients at the

appropriate changes made to the AML/CTF

beginning of the relationship when a demo

Program. Amendments will be communicated to

account is downloaded. At this stage the sales

those representatives affected by the changes.

team ascertain the trading experience of the

applicant and will canvass trading strategies

ONGOING CUSTOMER DUE DILIGENCE

and intended length of the relationship and

spend. This enables 1TradeMarket to monitor and

Ongoing customer due diligence is an important

identify any unusual trading activity, patterns of

component in mitigating and managing the ML/TF

spend with reference to the disclosed strategies

risks (potential and identified). 1TradeMarket maintains an

and relationship length.

ongoing relationship with its customers through

updating KYC information, implementation of a

(e)!

Sales staff accept withdrawal requests and will

transaction monitoring program

(TMP) and by

flag to the accounts team if there any

conducting enhanced customer due diligence.

discrepancies or attempted third party

1TradeMarket has systems in place to determine when

withdrawal requests;

further KYC or beneficial owner information should

be collected or verified to review and update

(f)!

New accounts staff re-verify customers if any

information. All customer records are reviewed

errors are identified on an account, or any

and updated where the ML/TF risk warrants this.

suspicion is formed;

This applies to both new and pre-existing

customers.

(g)!

The accounts and trading teams review

(a)!

All new accounts are screened for errors by the

transactions, including trading and electronic

new accounts team with supervision and

fund transfers, in the context of other account

guidance from the AML/CTF Compliance

activity to determine if a transaction is

Officer/ Head of Compliance.

suspicious. A formal TMP is in place;

(b)!

Sales and support staff maintaining an ongoing

(h)!

the AML/CTF Compliance Officer/Head of

relationship/ contact with clients. This contact is

Compliance is responsible for monitoring

both for commercial purposes, to provide

adherence to the AML/CTF Act, will document

ongoing technical support and also for the

when and how it is carried out, and will report

purposes of updating and maintaining KYC

suspicious activities to the appropriate

information by verifying name, date of birth and

authorities;

address. All notes are recorded in Salesforce in

the company’s account information. Customers

(i)!

exception reports are utilized to identify

are requested to provide evidence in the form

possible ML/TF risks and include monitoring

of proof of address documentation (such as a

transaction size, location, type, number and

utility or bank statement) to action a change of

nature of the activity;

address on the system;

(j)!

the AML/CTF Compliance Officer/ Head of

(c)!

Each member of the 1TradeMarket sales team maintains

Compliance conducts an appropriate

a list of their own customers. This list is

investigation before reporting a suspicious

monitored on a daily basis. Contact is therefore

matter.

maintained with all customers. Those customers

not actively trading are contacted to incentivize

Instances where 1TradeMarket re-verify for the purposes of

a return to trading. Those actively trading will

updating and maintain KYC information on all

be contacted to ensure everything is running

customers

12 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

are in an amount just below reporting or

1TradeMarket ensures that the information it retains about its

recording thresholds

customers is up to date. The trading team monitor

(ii)! The customer attempts to make frequent or

customer account activity, including trading and

large deposits of currency, insists on or asks for

electronic fund transfers on an ongoing basis. Staff

exemptions from the firm’s policies relating to

are trained to identify “triggers” for the requirement

the deposit of cash and cash equivalents.

to update KYC information. For example,

(iii)!For no apparent reason, the customer has

disconnected telephone numbers, returned mail.

multiple accounts under a single name or

multiple names, with a large number of inter-

Staff are trained to identify and verify beneficial

account or third-party transfers.

ownership information for all non-individual

(iv)!The customer has accounts in, a country

customer types on an ongoing basis. Where

identified as a non- cooperative country or

beneficial owner or true controllers are

territory by the Financial Action Task Force.

determined, additional KYC information is

(v)! The customer’s account has unexplained or

collected and verified.

sudden extensive wire activity, especially in

accounts that had little or no previous activity.

RISK BASED TRANSACTION MONITORING

(vi)!The customer’s account indicates large or

frequent wire transfers, immediately withdrawn

PROGRAM (TMP) TO MONITOR

without any apparent business purpose.

TRANSACTIONS

(vii)The customer makes a funds deposit followed

by an immediate request that the money be

1TradeMarket has a risk based transaction monitoring

wired out or transferred to a third party, or to

program

(TMP) to monitor transactions of

another firm, without any apparent business

customers, including regard to complex, unusual

purpose

large transactions and unusual patterns of

(viii)! The customer makes a funds deposit for the

transactions which have no apparent economic or

purpose of pursuing a long-term trading

visible lawful purpose

strategy, followed shortly thereafter by a

request to transfer the proceeds out of the

Staff in the new accounts team manually monitor

account.

accounts to ensure that there isn’t fraudulent

activity on the accounts, staff review ID, and look for

1TradeMarket ALSO HAS AN ENHANCED DUE

layering of funds using the trading accounts.

DILIGENCE PROGRAM

Transactions are monitored by staff on an ongoing

basis. Customers are monitored on an ongoing

Although it is 1TradeMarket’s policy not to accept customers

basis in order to identify any suspicious activity;

identified as high risk at the outset, it has

Staff are required to review deposit alerts, and

implemented an enhanced due diligence program

trading activity. Suspicious patterns are reported to

to include systems and controls to ensure, where

Manager of team in the first instance. This

appropriate, measures such as clarifying,

information is communicated to the AML/CTF

analyzing, verifying or updating beneficial owner

Compliance Officer/ Head of Compliance who will

information collected from the customer; or

apply enhanced customer due diligence

collecting further beneficial owner information

(such as the source of the beneficial owner’s funds

Accounts and sales staff are trained to look for

and wealth) are taken.

specific activity which is deemed a Red flag trigger,

as follows:-

1TradeMarket has implemented systems so that ongoing

due diligence is conducted on the business

(i)! The customer engaging in transactions

relationship and scrutinizing transactions to

involving cash or cash equivalents or other

ensure that the transactions are consistent with

monetary instruments that appear to be

the knowledge of the customer, and their

structured to avoid the $10,000 government

business and risk profile.

reporting requirements.

Enhanced due diligence will be undertaken for all

i.! especially if the cash or monetary instruments

high risk customers and transactions and where:

13 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

(a)! there is a requirement to access further

•! ELECTRONICALLY

information in order to clarify & update KYC

info;

1TradeMarket may also seek to utilise automated (exception)

(b)! obtain further KYC info;

reporting that will include a comprehensive sample

(c)! consider and investigate the suspicious

of activity and monitor things such as transaction

transaction;

size, location, type, number and nature of the

(d)! verify or re-verify information;

activity.

(e)! undertake more detailed analysis and

monitoring regarding transactions; and

The AML/CTF Compliance Officer/ Head of

(f)! lodge a suspicious matter report.

Compliance, will be responsible for performing

these ongoing monitoring activities.

Where it is determined that enhanced due

diligence should be applied, the process will be

They will document when and how it is carried out

as follows;

and will report suspicious activities to senior

management and/or the appropriate authorities

1.! AML/CTF Compliance Officer/ Head of

(where required). The AML/CTF Compliance

compliance will conduct a thorough

Officer/ Head of Compliance will conduct an

investigation to determine the source of the

appropriate investigation before reporting a

customer’s and each beneficial owner’s

suspicious matter.

wealth;

2.! Check the validity of the account registration

Employee guidelines with examples of suspicious

details;

money laundering activity and lists of high-risk

3.! Review any linked accounts;

customers that may warrant further scrutiny will

4.! Re-verify KYC information;

also be prepared and distributed to those

5.! Analyze the customer’s past transactions and

concerned.

possibly monitor future transactions if deemed

necessary;

In addition to regular reviews, circumstances may

6.! The purpose or nature of specific transactions

arise in which an otherwise low risk customer will

7.! Check IP address where possible to detect any

be elevated to high risk.

suspicious connection sources

8.! Determine if a suspicious matter report should

For example, a customer on commencement of the

be lodged in accordance with process set out

relationship may be classified as low risk. However,

below

after a change in client circumstances or activities,

the risk profile of the customer may be elevated to

Monitoring will be conducted either:

medium or high. An example of this is a client’s

change of country of residence.

•! MANUALLY

In circumstances where the customer’s risk profile

The AML/CTF Compliance Officer/ Head of

is elevated, further measures and controls will be

Compliance and senior management will ensure

implemented to mitigate and manage against

that a sufficient sample of activity will be selected

potential ML/TF risks, including the following:

to enable the identification of matters of concern,

such as patterns of unusual size, volume, type of

(i)! Immediate notification to all appropriate

transactions, foreign jurisdiction factors, or any of

representatives / business units;

the “triggers” identified.

(ii)! further KYC information and verification

procedures performed;

It is proposed that representatives will review

(iii)!an increase in the level on monitoring (i.e. in

transactions (including trading and electronic fund

accordance with the new classification or rating

transfers) in the context of other customer activity

of the customer risk, being medium or high and

to determine if a transaction lacks financial

monitoring intervals commensurate with the

rationale or is suspicious because it is an unusual

identified risk);

transaction or strategy for that customer, or

(iv)!Increased monitoring of transactions in

14 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

accordance with senior managements

requirements in respect of the customer or

Suspicion is formed when a representative

transaction.

considers that an existing or prospective customer

is attempting to use the services offered by 1TradeMarket for

SUSPICIOUS MATTER REPORTING

ML/TF purposes and/or any one of the following

(SMRS)

conditions is met:

(i)!

the representative suspects on reasonable

1TradeMarket has implemented monitoring and reporting

systems in respect of designated services offered

grounds that the customer is not the person

they claim to be;

across all relevant business units.

(ii)!

the representative suspects on reasonable

grounds that the customers agent is not the

Relevant employees are trained to identify and

report suspicious matters to the Head of

person they claim to be;

(iii)!

the representative suspects on reasonable

Compliance AML/CTF Compliance Officer/ Head

grounds that the provision, or prospective

of Compliance.

provision, of the service is preparatory to the

commission of an offence of financing of

The AML/CTF Compliance Officer/ Head of

terrorism;

Compliance is adequately trained to investigate

suspicious matters, prepare, lodge and retain

(iv)!

the representative suspects on reasonable

grounds that information collected by 1TradeMarket

records of suspicious matter reporting.

concerning the provision, or prospective

provision of the service may be relevant to the

Staff are trained to be aware of potential indicators

that will trigger a suspicion. The aim is to identify

investigation of, or prosecution of, a person or

entity for an offence of financing of terrorism;

those prospective (or existing) customers that are

(v)!

the representative suspects on reasonable

seeking to use the services offered by 1TradeMarket for

money laundering or terrorist financing purposes,

grounds that the provision, or prospective

provision, of the service is preparatory to the

thereby triggering reporting obligations to the

commission of an offence of money laundering;

relevant authorities.

(vi)!

the representative suspects on reasonable

grounds that information collected by 1TradeMarket

The AML/CTF Compliance Officer/ Head of

concerning the provision, or prospective

Compliance is responsible for submitting SMR’s,

provision, of the service may be relevant to the

however staff are aware that it is a shared

responsibility to be vigilant in respect of any

investigation of, or prosecution of, a person or

entity for an offence of money laundering.

suspicious matters.

(vii)! the representative suspects on reasonable

An SMR must be submitted by the AML/CTF

grounds that information collected by 1TradeMarket

Compliance Officer/ Head of Compliance within

concerning the provision or prospective

provision of services:

three business days of forming the suspicion. If the

suspicion relates to the financing of terrorism, the

(viii)! may be relevant to investigation of, or

SMR must be submitted within 24 hours of forming

prosecution of a person or entity for an evasion,

or an attempted evasion of taxation law;

the suspicion.

(ix)! may be relevant to investigation of, or

prosecution of a person or entity for an evasion,

Staff are trained to avoid “tipping off” in respect of

or an attempted evasion, of a law of a State or

suspicious matters to avoid wrongfully disclosing

Territory that deals with taxation; or

to others, information about a suspicious matter.

(x)! may be relevant to investigation of, or

Staff are aware that this is an offence.

prosecution of a person or entity for, an offence

against a law of the Commonwealth or of a State

If staff form a suspicion whilst dealing with a

or Territory; or

prospective (or existing) customers, this suspicion

must be referred to the AML/CTF Compliance

(xi)! may be of assistance in the enforcement of the

Proceeds of Crime Act 2002 or regulations

officer/ Head of Compliance who will make a

under that Act; or

decision as to whether a suspicious matter report

should be submitted

(xii)! may be of assistance in the enforcement of a

15 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

law of a State or Territory that corresponds to

•! assess whether Part A of the AML/CTF Program

the Proceeds of Crime Act 2002 or regulations

has been effectively implemented; and

under that Act;

•! assess whether 1TradeMarket have complied with Part A

of the AML/CTF Program.

THRESHOLD TRANSACTIONS REPORTS

The result of the review, including any report

1TradeMarket will design and implement robust systems to

prepared, will be provided to the Board, the

detect threshold transactions covering all

Compliance Committee and senior management.

prescribed requirements. Currently, the

A draft checklist entitled “Independent Review of

prescribed threshold amount is $10,000 i.e. cash

the AML/CTF Program”.

transactions in excess of this amount must be

reported to AUSTRAC. 1TradeMarket has confirmation

Record Keeping:

stating they are not required to report these

transactions as these are reported directly from

In accordance with meeting legislative obligations,

the bank receiving funds.

1TradeMarket will retain all records relevant to its AML/CTF

Program and policies, including the following:

AML/CTF COMPLIANCE REPORT

1.! the AML/CTF Program and all reviews and

An AML/CTF Compliance Report is an annual

addendums to the same;

2.! its AML/CTF Policy and all reviews and

report which 1TradeMarket prepares that helps provide

addendums to the same;

authorities with information on our compliance

3.! transactional records;

with the Anti-Money Laundering and Counter-

Terrorism Financing Act 2006 (AML/CTF Act), the

4.! Customer identification and verification

records;

regulations and the Anti-Money Laundering and

5.! Audits and compliance reviews;

Counter-Terrorism Financing Rules Instrument

2007(No.1)

(AML/CTF Rules). AML/CTF

6.! Suspicious matter reporting (from 13

December 2008);

Compliance Report contributes to monitoring of

7.! Threshold reporting (from 13 December 2008);

ongoing industry compliance with the AML/CTF

8.! Senior management approvals;

Act, the regulations and the AML/CTF Rules. 1TradeMarket

9.! Customer account/relationship records;

follows the AML/CTF Act obligations and

10.!Annual compliance reports and other

completes an AML/CTF Compliance Report

management reports;

before 31 March of each year.

11.!Training and compliance monitoring reports;

and

INDEPENDENT REVIEW OF PART A OF

12.!Information relating to the effectiveness of

THE AML/CTF PROGRAM

training.

A review of Part A of the AML/CTF Program will be

Records in respect of customer identification and

undertaken annually. The review will be undertaken

verification are retained for 7 years after account

either:

closure.

Where 1TradeMarket (or its agent or intermediary) carries

•! internally i.e. by a person separate from the

out a customer identification and verification

AML/CTF Compliance Office

(or his/her

procedure with respect to a prospective customer

department or direct control); or

to whom 1TradeMarket proposes to provide a designated

•! by an external service provider that will be

service, it must make (and retain) a record of:

retained to conduct the review.

(i)! the procedure (i.e. the Checklist); and

The purposes of the review will be to:

(ii)! information obtained in the course of carrying

out the procedure

(i.e.

supporting

•! assess the effectiveness of Part A of the AML/CTF

documentation to verify the identification of

Program, having specific regard to the ML/TF

the customer); and

risks faced by 1TradeMarket;

(iii)!such other information

(if any) about the

•! assess whether Part A of the AML/CTF Program

procedure as is specified in the AML/CTF

complies with the AML/CTF Rules;

16 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!

!

Rules

(currently no further information is

training programs in respect of the change to

specified).

ML/TF risks and will oversee the delivery of

training programs.

Records in respect of financial transactions are to

9.! The AML/CTF Compliance Officer/ Head of

be retained for 7 years after the date of the

Compliance will retain all records relevant to

transaction.

the risk assessment, addendums to the

AML/CTF Program and the training programs.

AML/CTF Program and addendums together with

10.!The AML/CTF Compliance Officer/ Head of

any documentation relevant to the reason for

Compliance, under the direction of the Board,

amendment are also to be retained for 7 years

will ensure that any government or FATF

after the adoption of the AML/CTF Program and/

findings concerning the approach to money

or amendments cease to be in force.

laundering and terrorism financing prevention

in particular countries or jurisdictions, is

SYSTEMS TO RE-ASSESS RISK

assessed and appropriate amendments made

to the AML/CTF Program. Furthermore, all

1TradeMarket will review all areas of its business to identify

compliance procedures will be made and

potential ML/TF risks that may not be covered in

communicated to all representatives.

the procedures described above. The additional

areas of ML/TF risks are in respect of new

EXTERNAL AUTHORITIES

products, services, distribution channels and

developing technologies.

1TradeMarket will co-operate with all external authorities.

Additional procedures to address these ML/TF risks

1TradeMarket will comply with any directions or notices

are as follows:

received from such bodies and will actively search

and retain records of any guidance issued or

1.!

The AML/CTF Compliance Officer/ Head of

released in respect of perceived ML/TF risks.

Compliance will be consulted by any person

having responsibility for a new service or

PRIVACY

method of delivery or new technology (“the

project manager”) at design stage or prior to

Customer identification

and verification

the introduction of the new service, delivery

procedures will be carried out having regard to the

method or technology. He will be required to

Privacy Act

1988. 1TradeMarket’s Privacy Policy and

advise on the ML/TF risk factors which are to be

Disclosure Document/s (e.g. the Financial Services

considered having regard to:

Guide and Product Disclosure Statements) will be

2.!

the target market (customer type);

amended to include the following disclosure:

3.!

the service features;

4.!

foreign jurisdictional features / offerings;

(i)! that personal information may be collected

5.!

any electronic access to / the delivery method

because 1TradeMarket is obliged by Law to collect

of the service.

certain information

(for example, the Anti

6.!

The AML/CTF Compliance Officer/ Head of

Money Laundering Counter Terrorism

Compliance will, in consultation with the project

Financing Act 2006 requires 1TradeMarket to collect

manager undertake the risk assessment and

information and verify the identity of its clients /

formulate the controls and systems to manage

customers. This is often referred to as “know

any ML/TF risks.

your customer” information);

7.!

The AML/CTF Compliance Officer/ Head of

(ii)! that information may be collected from other

Compliance will review the AML/CTF Program,

persons or organizations and a listing of those

policies and procedures to ensure that any new

sources including agents, brokers, publicly

ML/TF risks are identified in the AML/CTF

available information and documents; and

Program and amendments to the AML/CTF

(iii)! that where required by Law, the client or

Program are made. All amendments will be

customer’s personal information may be

overseen by senior management and will

disclosed to other parties.

require Board approval.

8.!

The AML/CTF Compliance Officer/ Head of

Compliance will formulate staff awareness and

17 | Anti-Money Laundering and Counter-Terrorism Financing Program | 1TradeMarket

!